CAN NEW CAMPAIGN CUT COST OF DOING BUSINESS IN IRELAND?

Business organisations including the Irish Hairdressers Federation collaborate on pushing for lower VAT rate as part of new SaveJobs campaign.

A new campaign to reduce the cost of doing business is launching from an alliance of

organisations representing and supporting small businesses across Ireland, including the

Irish Hairdressers Federation and the Hair and Beauty Industry Confederation.

The SaveJobs campaign is fighting for a permanent 9 per cent VAT rate for the personal

grooming, entertainment and experiential, and food services sectors.

Together, they aim to reduce the cost of doing business, create more jobs, and help small

businesses thrive by advocating for supportive policies and relieving burdens imposed by

government policies.

Within the campaign, the alliance spotlights how Irish SMEs cannot compete with wage

premiums paid by multi-national employers and public services. It says benchmarking the

minimum wage against these will fail, costing jobs and businesses.

It’s also pushing for small businesses to be heard in discussions about employment terms. It points to the Labour Employer Economic Forum, which it argues lacks small business representation, even though SMEs employ 60 per cent of the Irish workforce. It’s pushing for pro-rata representation on the Forum.

To sign the pledge and join the campaign, visit savejobs.ie/takeaction

In addition to the Irish Hairdressers Federation and the Hair and Beauty Industry

Confederation, organisations that have signed up to the Savejobs.ie campaign include:the

Restaurants Association of Ireland; Irish Hardware Association; Nursing Homes Ireland;

Retail Excellence Ireland; Vintners’ Federation of Ireland; and Convenience Stores &

Newsagents Association.

Related

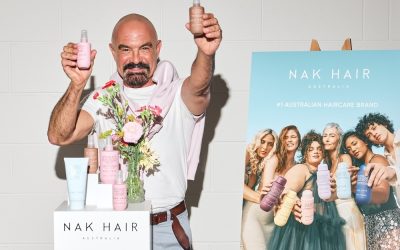

Big Name Revealed For NAK Hair

Industry icon takes on European brand ambassador role

Visionaries: Remastered Graduate

Closing ceremony to honour this year’s cohort from Revlon Professional mentoring scheme

Who Won The Remi Cachet Crown?

Winners of annual Extensionist of the Year Awards revealed in Manchester