The Thrill Of The New

The Thrill Of The New

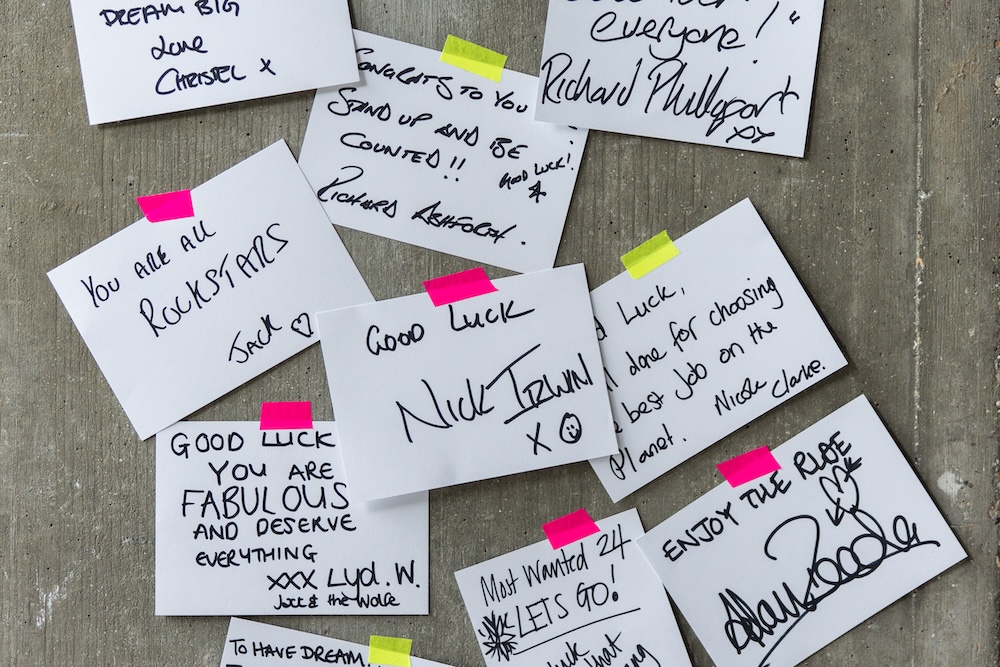

They’re young. They’re innovative. They’re fearless. The winners of the It List 2024, presented by Creative HEAD in an exclusive association with ghd, send out a remarkable snapshot of the energy coming out of British and Irish hairdressing right now – six young talents challenging existing ways of operating both as creatives and in business. “Remember their names,” says Creative HEAD Editorial Director Amanda Nottage, “because these It List-ers are setting an exciting new direction for the future of hairdressing, and it’s rooted in authenticity, creativity and responsibility. And that’s good for all of us.”

THE RISING STAR

D’Arcy White,

Jack & The Wolfe

Having been diagnosed with Austism Spectrum Disorder at age 11, a challenging social environment like the salon was one of the last places D’Arcy expected to thrive – but the Jack & The Wolfe team successfully mentored her every step of the way. Aged just 23, she’s now created a non-profit organisation, Artistic and Autistic, to help other autistic individuals thrive in creative environments.

What’s your career superpower?

I completely adore the world of colour. In the future, I want to be known for anything that is seamless and expensive looking. I’m just four years into the industry and still building my clientele but I’m so proud that people have approached me via Instagram, especially having heard locally about my achievements!

Who is your hairdressing idol?

Jack Mead and Lydia Wolfe (not that I’m biased). I love their professional but chilled approach to hairdressing. They have introduced me to so many creatives in this industry and I’m so very lucky to have been taught by them!

How does it feel to be part of an elite group of young hairdressers who are redefining how the industry looks, feels and operates?

It’s exciting. I’m so inspired by people around me in the salon and on Instagram and I can’t wait to see what the industry looks like in 50 years’ time!

Where, in an ideal world, do you see yourself in five years’ time?

What an exciting question! I have recently just become self-employed, which I hope will give me a better work-life balance, and my goal is to go into the film and TV industry. I am also in the process of setting up an organisation called Artistic and Autistic, which will help empower autistic individuals and raise awareness on how valuable autism can be to creative industries.

“Sell” hairdressing as a career to a 16-year-old school kid…

Dear D’Arcy, This path you’re drawn to… follow it. Hairdressing won’t just be a job; it’ll be your art, your voice, your rebellion. You’ll turn chairs into stages, scissors and colour brushes into your art materials. You will win awards, and hopefully you will inspire the neuro diverse community that anything is possible and that whatever you put your mind to it can work on your favour, so long as you work hard. This isn’t a backup plan. It’s your calling.

THE BUSINESS BUILDER

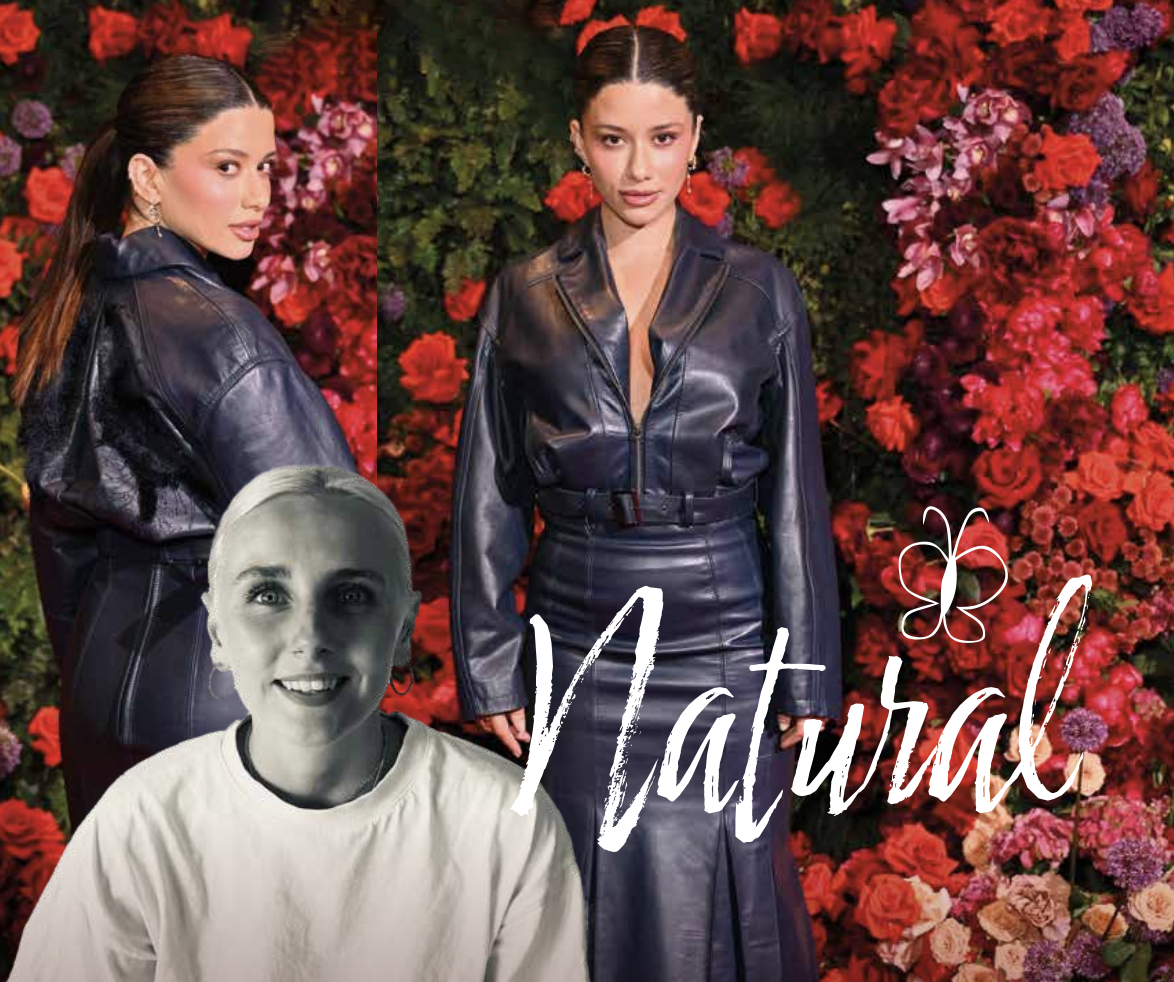

Chlöe Swift

Chlöe is a stylist who was always destined to shake up the world of hair. She is so good at translating trends and techniques into high-impact digital content that what started as a few styling tutorials quickly became a digital revolution, and after winning the Business Builder award at her first attempt, she’s quickly turning her talent into an empire, with brands like Sephora, Soho House, and Sheerluxe lining up to collaborate.

What is your key strength when it comes to your career?

Digital is what sets me apart from the traditional hairdressing industry and has allowed me to shape the career that I have today. I have always loved digital media, obtaining an A in Media Studies back in school, and I would have gone on to study more down this route if I hadn’t gone into hairdressing. I am always quick to adapt to tech, trying new apps and programmes. I love video editing, having taught myself long before reels came out and so I love that my passion for media has really merged with my hairdressing career and I’ve almost come full circle (NB almost – I have much more work to do yet!).

How does it feel to be an It Lister?

It feels AMAZING! The It List crowd is something I always imagined being a part of and so I am super proud that I am involved with this community of creatives who can hopefully help to shape what ‘hairdressing’ is.

What frustrates you about the industry?

Hairdressers who are resistant to change. It doesn’t matter how old or young you are, it is so important to pick up new apps and programmes, learn new skills and embrace the future – it’s what’s making hairdressing more powerful and more seen.

What, in an ideal world, do the next five years hold for you?

I will have launched my second business (wink, wink) and this will be my main focus. I will be partnering with training academies, really shaping how hair styling is taught and learnt by young professionals. I will continue to travel, working with global hair brands on the right content to market their products. I will be hosting masterclasses/workshops/taking part in panel talks and continuing to educate consumers in the world of hair. And I’m still waiting for my presenting gig on This Morning to showcase all my hair tips, tricks and knowledge, so hopefully that happens! (Basically, what DON’T I want to do? Dream big, right?)

“Sell” hairdressing as a career to a 16-year-old school kid…

Okay, this a hard one. So… Do you love being creative? This could involve creating a whole new look for someone which they’ll love or creating a trend moodboard to present to a brand or creating a marketing and video concept to promote a new product (the creativity is endless). Do you love chatting and being around cool people? This could involve chatting to your audience on YouTube whilst demonstrating a hair styling tutorial or chatting to a full team on a campaign shoot about the storyboard and if that movement will work with the model’s hair (the chatting and cool people are honestly endless). And do you want to work from anywhere in the world and quite literally at any time? (You guessed it, ENDLESS!) If you answered yes to any of the above, then hairdressing could be for you…

THE SALON STYLIST

Norman Boulton,

Freelance

£134,800 worth of services sold… £9,649 worth of retail sold… 67 per cent rebooking rate… 57 per cent client retention… The numbers don’t lie: “Stormin” Norman Boulton is a force to be reckoned with on the salon floor, not only creating his distinctive vivid colour looks but also radiating kindness at every turn – no wonder he won this award for the second year in a row. Having honed his skills at Not Another Salon, Norman’s now his own boss, working freelance out of Glitterball Balayage in north London while carving his own space in the education world. “Some of my best career moments have been while teaching,” he says

Why did you enter The It List?

Honestly? I wanted to be recognised for the effort I was putting into my career. I’d been pouring my heart and soul into projects for other people and brands for so long, and I needed something that was just for me.

Describe your feelings when your name was announced as the winner?

Ha ha! I felt like Marilyn Monroe winning an Oscar. I’d been practising a speech in the shower for weeks, just in case, visualising the moment with my eyes closed, holding that award in my hands. So when it actually happened – when they actually called my name – it felt surreal. Everything I’d worked so hard for was recognised in that moment. I don’t think I stopped smiling all night.

What are your ambitions for the future?

I’d say my connection with people – that’s my superpower. Oh, and precision. Clean, sharp, polished work. Every. Single. Time.

Who is your hairdressing idol?

Lesley Jennison is my ultimate colour hero. Her energy is just next level, and her work blows my mind. She’s an icon. Lesley, if you’re reading this… let me assist you, please!

How does it feel to be part of an elite group of young hairdressers redefining the industry?

To to be part of this new wave – a generation that’s reshaping the industry in such a positive way – is something special. We’re moving away from the “sweep the floor with a toothbrush” era and towards a career path that’s respected, empowering and full of possibility. The industry is having a glow-up, and I’m proud to be part of it.

Is there anything about the industry you’d like to change?

Definitely, the way some people view hairdressers and our pricing structures. No one bats an eye at paying for tattoos or Botox – both of which can be done in minutes – yet somehow there’s still debate about the value of hairdressing. We’re on our feet for hours, we invest in products, training, education, the whole shebang. We deserve to make a great living doing what we love.

What do the next five years hold for you?

Okay, first things first – I want a puppy. That’s the top of my vision board and my main focus at all times. Career-wise, I’m loving my current balance. I’m fully booked as a freelance stylist, and the education side of my work is taking off in ways I’d only dreamed of.

THE VISIONARY

Emy Rocabella,

Danilo Hair Boutique

Perpetually hunting for a creative project to immerse herself in, the It List Visionary proved to be Emy’s perfect outlet. Her in-built taste for intricacy in styling and a determination to succeed drive this ambitious senior stylist and colourist, whose work reflects an elegant simplicity, inspired by contemporary and mode.

Why did you enter the It List 2024?

Because I wanted to challenge myself and step outside my comfort zone. I’ve worked hard over the years, growing my skills, learning from others and trying to create work that tells a story. This felt like the right time to put myself forward, not because I think I’ve ‘made it,’ but because I’m still evolving. I saw this as an opportunity to grow, connect with other creatives and be part of something that celebrates the future of our industry.

What went through your mind when your name was announced as the winner?

I felt a bit stunned, to be honest. It took a moment to sink in. Then I just felt really thankful — for the people who’ve supported me and for the chance to be recognised for doing what I love.

What is your key strength in your career?

My ability to adapt creatively, whether on set, backstage or with a client. I stay calm under pressure, think quickly, and always focus on bringing a clear vision to life while staying open to collaboration.

Who do you most look up to?

Guido Palau. His ability to set the tone for entire fashion seasons through hair is incredible – he’s always pushing boundaries while keeping it relevant and wearable. He’ s a true visionary who makes hair a central part of storytelling.

Is there anything about the industry that frustrates you/that you’d like to change?

It frustrates me how often hair is seen as an afterthought in creative projects. In reality, it plays a huge role in storytelling and mood. I’d love to see hairdressers not just execute a brief, but help shape it.

Where do you see yourself in five years’ time?

I’d love to continue building a career that balances creative and session work with my responsibilities in the salon. I want to grow my presence in the fashion space while making sure our salon team grows too by being first in line to provide and organise in-salon education, a nd by offering each stylist their own personalised plan for development. It’ s about evolving together while staying inspired.

THE EDITORIAL STYLIST

Mike Mahoney,

Josh Wood Atelier

This It List victory marked an exciting milestone for Mike, a stylist who is all about pushing creative boundaries in both salon and editorial settings. From high-stakes fashion shows as a member of Gary Gill’s core team, to behind-the-chair transformations at the Josh Wood Atelier in London, he merges high fashion with salon accessibility, inspiring a new wave of stylists with every look. Reflecting on his career, Mike credits his two mentors with helping him balance creativity with financial stability. “It’s about finding the right environment,” he shares. “With a supportive salon, you don’t have to choose between your creative ambitions and personal goals.”

And the winner is… What went through your mind?

Well, you sit there with a table of supporters and a load of other heads in the building cheering you on. That’s enough pressure in itself! Then your name gets called, the tables around you explode, you give the missus a hug, give the boss Josh Wood a hug followed by the rest of the team… You start walking to the stage pointing at the icon Gary Gill over the other side of the room like you’ve scored a winning goal in a football final. And then you’re on stage. Mad!

What would you describe as your key strength?

I enjoy what I do! I always say to people, ‘Imagine painting a picture you hate’. You’re never going to put 100% into it.

How does it feel to be part of the new cohort leading and influencing the hairdressing industry?

It feels great to be recognised for all the hard work I’ve put in. I got asked to do my first hair seminar at Nick Barfords Nudo studio in East London, in front of 25 young aspiring hairdressers. What a moment that was, preaching the way I think we should all approach hair in this tough industry!

Hairdressing as a career… Do schools do enough?

I was talking to a secondary school teacher recently and he said he was told off for promoting apprenticeships to certain kids, rather than university. Apparently, schools are marked and judged on how many kids go to university. This touched a nerve because I feel this is pushing young creatives away from their passion and – worse still – putting young kids into the stress of debt. Many of my friends have gone to uni. Some have succeeded with their degree, but many haven’t! So, my answer to this would be, Follow what you think is right and don’t listen to everything your teachers say. There’s money to be made in hairdressing, and great experiences to be had, believe me!

And finally, you in five years’ time?

I’d love to build a collective of hairdressers / creatives who are pushing to bring good, talented people together to inspire and support the next generation. I feel the industry needs it!

THE ONE TO WATCH

Emma Vickery,

Percy & Reed

At just 29 years of age, Emma is not only Percy & Reed’s first ever Art Director (she was pivotal in the salon’s recent rebrand) but also session stylist Paul Percival’s first assistant, having honed her skills by saying yes to every bit of TFP (time for portfolio/testing) she could find on weekends and quiet days. Her mantra sums up her uncompromising approach to hairdressing: “Unwavering self-reliance, mutual accountability and an affinity for intensity!”

Why did you enter the It List?

I’ve entered every year for the last three years. The event itself is great, obviously, but on a personal level I get a real sense of achievement taking the time to look back through the work I’ve done during to put together my entry. Last year was the first time I felt I had compiled a really strong portfolio. I’d spent years giving up all my free time to do the things I wanted to do outside of the salon and it paid off.

What is your key strength as a hairdresser?

I’m great at listening to clients. I’ll always give them my advice but, ultimately, they’re paying, so I’ll give them what they want and tailor it to them. Every client is bespoke. Who is your hairdressing idol? Tom Connell. I love his approach, how much time he puts into what he creates. Everything has purpose and the attention detail is second to none.

Is there anything about the industry that frustrates you/that you’d like to change?

To be honest I don’t focus on industry noise. I like to stay in my own lane, keep my head down and focus on achieving my own goals.

What, in an ideal world, do the next five years hold for you?

I’d like to keep on doing what I’m doing. Working hard and staying disciplined will always lead you to where and what is meant for you. “Sell” hairdressing as a career to a 16-year-old school kid. You can have a great life with plenty of opportunity, both financially and creatively. But don’t fall into the trap of relying on others. Only you can create your own opportunities. Get out there, stay uncomfortable, continue to learn and everything else will follow in due course.