Open For Business – Salon Smart 2026 Tickets Are On Sale Now

Open For Business – Salon Smart 2026 Tickets Are On Sale Now

Creative HEAD’s business education and networking event returns on Monday 13 April – in a brand-new venue, with a packaged agenda, a stellar speaker line-up, and one important mission: to help you build a better business in 2026 – and beyond.

by JOANNA | CONNECT

For 20 years, Salon Smart has been supporting salon and barbershop owners and managers in the UK and Ireland with a carefully curated event agenda packed with candid talks and hot-topic discussion and debate, all delivered by industry innovators, alongside invaluable meet-and-greet opportunities with the hair and business brands that can revolutionise the way you work.

Real and relevant, fresh and forward-thinking, Salon Smart provides a space to connect, learn and grow and has fostered a strong sense of community; in fact, togetherness is the beating heart of Salon Smart. Large or small, urban or rural, established or newly launched, the one-day event agenda is abuzz with information, advice and inspiration for every business.

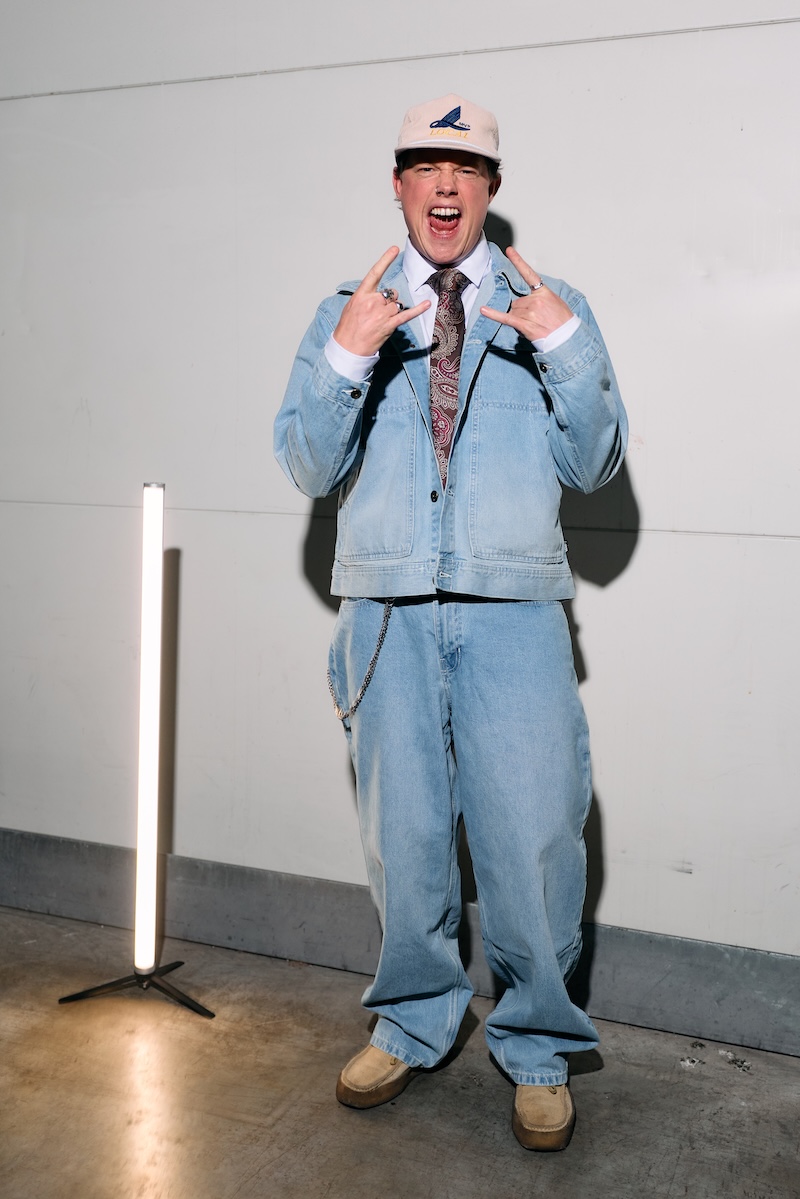

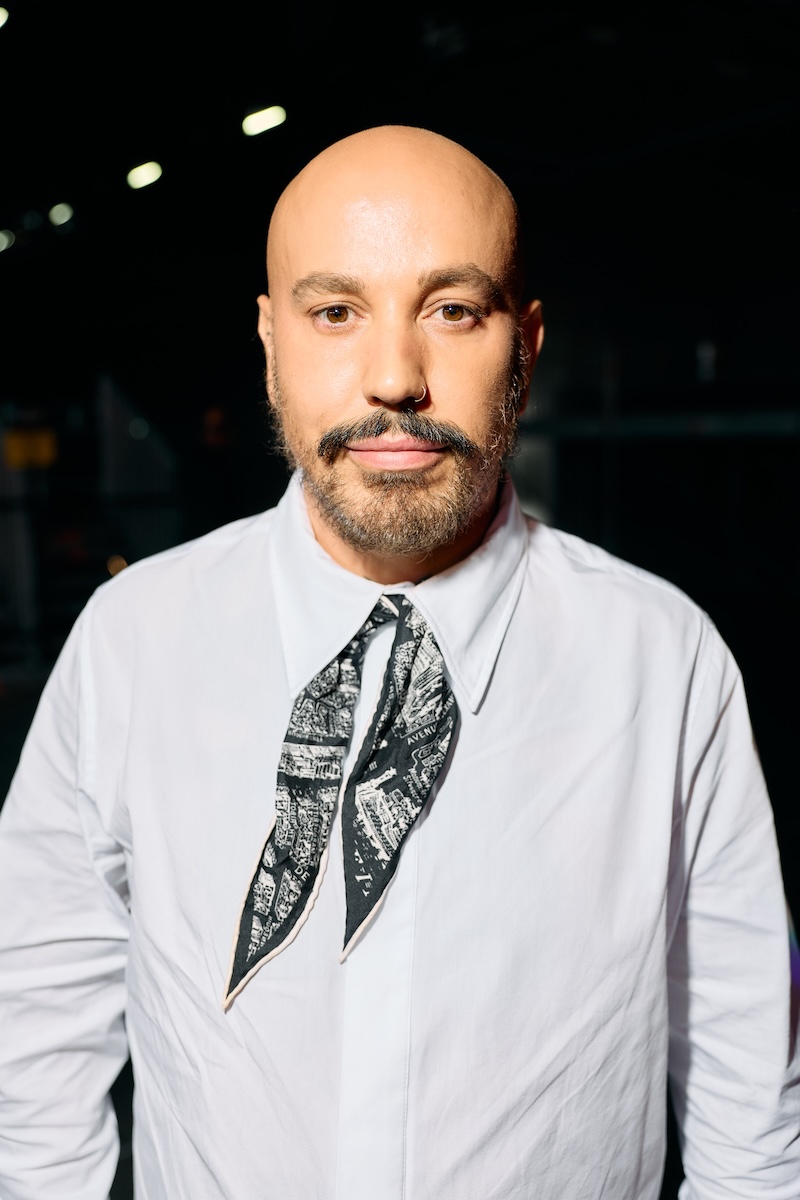

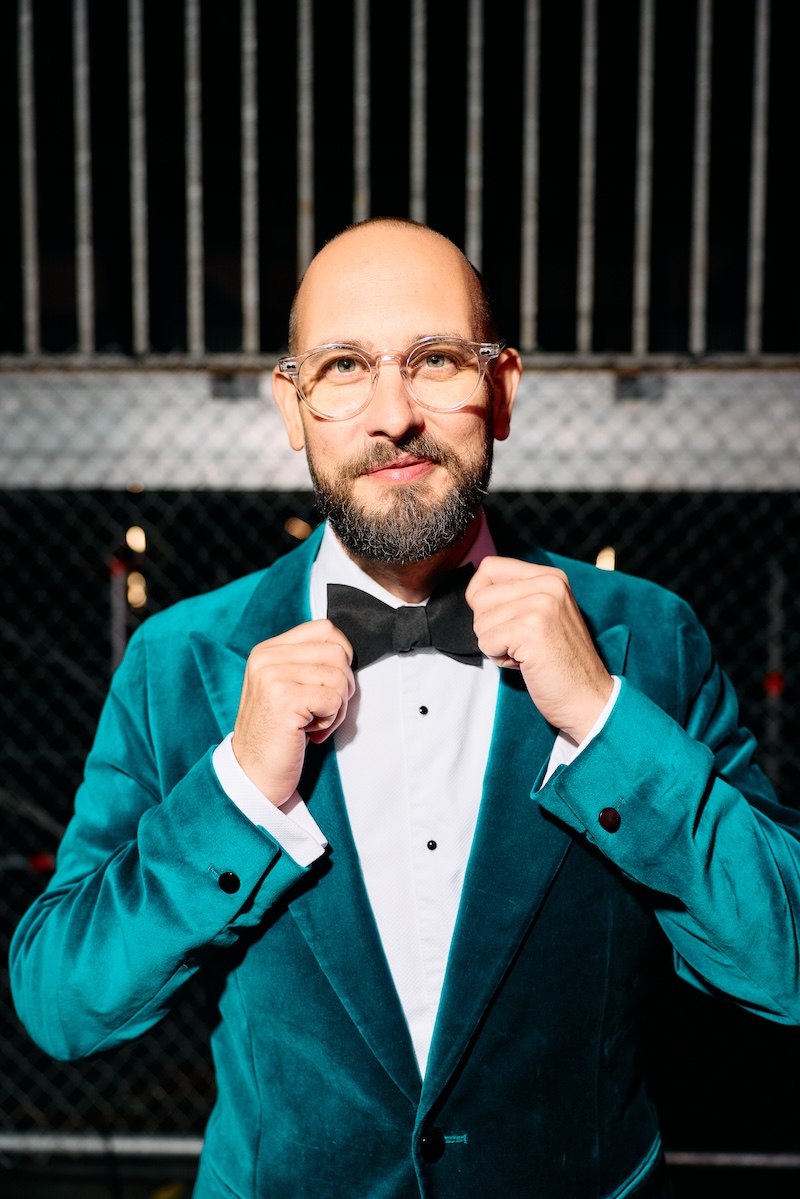

At Salon Smart 2026, you’ll hear from passionate employers such as Jo and Steve Dyer (Yoke, Plymouth), Sally Montague and Emmanuelle Montague Sayers (Sally Montague Hair Group, Midlands), Carolyn Sweeney (Creations, Chichester), and brother and sister duo Billy Ryan and Elle Foreman (Tribe Salons, London), who’s ‘take’ on ‘team’ earned Elle the One To Watch title at this year’s It List awards. In good company with many others, hear their hacks from the coal face, get introduced to professional brands who can support your journey ahead, and enjoy lunch with dozens of business owners just like you.

And there’s more to get excited about! This year, Salon Smart moves into a brand-new venue offering comfortable and stylish surroundings, serving delicious food and all-day refreshments, and located a stone’s throw from London’s Liverpool Street Station, providing excellent transport links. You’re welcome!

Tickets cost £150 plus VAT, and everything’s included – we’re even throwing in complimentary two-day access to HairCon in June! That’s outstanding value, so book now and get set for a brilliant year ahead.